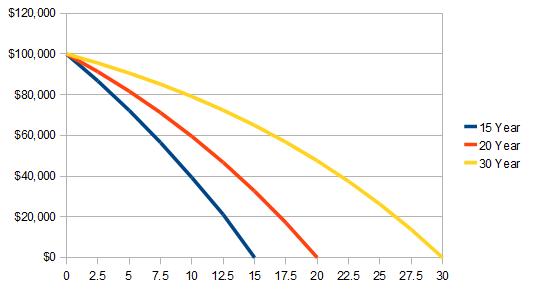

It helps get rid of costly interest charges that should go towards savings and emergency funds. in Idaho:Ī shorter term allows you to pay off your loan faster. Robinson is the owner of First Choice Mortgage Co. In a Washington Post article featuring mortgage broker Jerry Robinson, he stated that more buyers should seriously consider a 20-year fixed mortgage. Likewise, some buyers refinance to a 20-year term after 2 or 3 years into a 30-year mortgage. If you can take this type of mortgage, you don’t have to worry about refinancing to a shorter term. Twenty-year fixed mortgages have more affordable monthly payments compared to a 15-year term. The good news? You can secure a shorter term even if you can’t afford a 15-year fixed-rate loan. Furthermore, borrowers who try to obtain 10 or 15-year mortgages are often limited to a smaller loan amount. However, this is steep for consumers who cannot afford higher monthly payments. A more common option is a 15-year fixed mortgage. While 30-year fixed-rate options dominate the market, people still look for a shorter term. Why Do Buyers Obtain a 20-Year Fixed-Rate Home Loan?Ī 20-year fixed-rate mortgage provides buyers with an alternative to 30-year loans. If you want to refinance, you’ll have to look for another lender. On the downside, borrowers with 20 or 15-year loans do not qualify for this program. Check with an approved USDA lender to see if you can apply. Furthermore, borrowers must have a record of 12 consecutive on-time payments. To qualify, your home must be a primary residence in a USDA area. Homeowners with 30-year fixed mortgages are eligible for USDA streamlined assist refinance program.

*Check If You Qualify for USDA Refinancing Instead they are typically backed by Fannie Mae & Freddie Mac, which are government sponsored entities (GSEs). Conventional loans are not directly backed by the Federal government.Department of Veterans Affairs backs VA loans Department of Agriculture backs USDA loans * The Federal Housing Administration backs FHA loans.The following are examples of government-backed mortgages: Other government-sponsored mortgages like USDA loans and VA loans offer zero downpayment options. You can qualify for a government-backed mortgage (FHA loan) if your credit score is 500, along with a 10 percent downpayment. This is suited for low to moderate-income buyers who often have low credit scores. Government-sponsored loans are federally funded to help majority of buyers afford a home. To qualify for a jumbo loan, you must have a credit score of 700 and above. These are used to purchase more expensive property.

Non-conforming loans are only obtained by borrowers with excellent credit scores and high income. Because these loans surpass the conforming limit, they are also called a “ jumbo mortgage.” Jumbo mortgages are offered by private lenders such as banks, mortgage companies, and credit unions. The limit in high-cost areas is 150% of the baseline.Ĭonventional loans that do not adhere to conforming limits are called non-conforming conventional loans. Beyond this limit, a mortgage is classified as a non-conforming conventional loan, also known in as a jumbo loan. continental loan limit is set at $647,200 in 2022. Under the 2008 Housing and Economic Recovery Act, conforming limits must be adjusted annually to accurately reflect changes in market home price. Apart from the 20-year fixed-rate loan, conventional loans are available in many terms, including the following:Ī conventional mortgage is considered a conforming loan when it falls under the financing limits set by the Federal Housing Finance Agency (FHFA). Only borrowers with credit scores of 650 and up are eligible for this loan option. Conventional loans are appropriate for buyers with a good credit score, high salary, and a steady source of income. They are offered by private mortgage companies, banks, and credit unions. If you’re planning to purchase a home, you will find 20-year fixed mortgages in the following types of loans: Conforming Conventional LoansĬonventional loans are a type of mortgage which is not federally-backed by the government. Types of Mortgage That Offer 20-Year Fixed-Rate Loans

0 kommentar(er)

0 kommentar(er)